SME finance management platform YouBiz launches competitive global transfers to over 140 countries for businesses of all sizes

- Written by Telegraph Magazine

- SMEs can instantly initiate non-local transfers in 8 major currencies to 146 countries

- Businesses enjoy up to 6x more savings on remittances with YouBiz

- YouBiz is one of the most competitive finance management platforms in the market that offers remittance services in addition to a suite of multi-currency features

SINGAPORE - Media OutReach - 11 November 2022 - YouBiz, the SME finance management platform by leading Southeast Asian fintech YouTrip, launched global transfers in 8 major currencies to a total of 146 countries today. SMEs can now remit money to more locations while enjoying the best in market exchange rates and up to 6X more savings on their transfers, compared to traditional banks and other money transfer operators. These features enable YouBiz to be the best platform for global-minded companies of all sizes to manage their budgets and scale internationally.

"During the pandemic, many SMEs adopted digital tools and payment modes for their business operations. YouBiz identified opportunities to close the remittance gaps that these local companies face and launched key transfer features to power their multi-currency remittance needs. We enhanced our platform and introduced even more features to free up valuable time and resources from finance management, for business owners to remain laser-focused on their growth and expansion plans," said YouTrip Co-Founder and CEO Caecilia Chu.

Affordable remittances at the best in market exchange rates

A recent study showed that the total volume of international digital remittances is set to exceed 2 billion globally in 2027, beyond the estimated 1.1 billion this year[1]. Many local businesses are in need of a smart and affordable financial solution that enables easy, effective and efficient cross-border payments and remittances - which can be categorised into local and non-local transfers.

- Local transfers refer to the transfer of currencies into an account within the corresponding home country i.e. the transfer of USD to the US.

- Non-local transfers refer to the transfer of currencies into an account outside of the corresponding home country i.e. the transfer of USD to China.

With the launch, YouBiz users are able to make non-local transfers in 8 major foreign currencies (AUD, CHF, EUR, GBP, HKD, JPY, THB and USD) to 146 countries. On the other hand, local transfers are available in the 8 major foreign currencies previously listed, as well as 4 other currencies (SGD, IDR, MYR and VND).

Businesses can create up to 30 accounts in SGD and each of the 8 major foreign currencies to manage various department and project budgets, lock in favorable exchange rates or receive payments - at no additional charge.

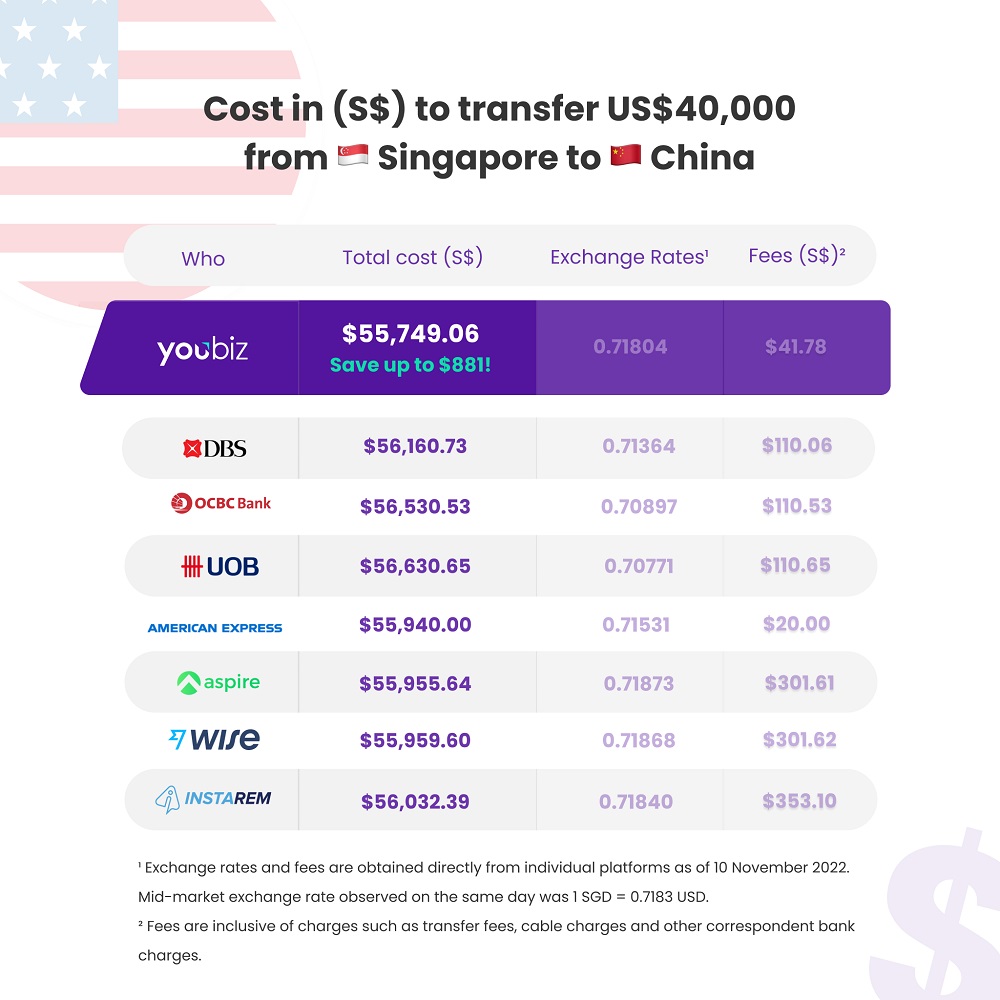

In their research and conversation with users, YouBiz conducted comparisons across various money transfer providers in the market, with USD40,000 as the average remittance amount. Findings show that SMEs can potentially earn up to 6X savings when making remittances with the best in market exchange rates and low, transparent fees offered by YouBiz (see Table 1 below).

Unlocking international growth for SMEs of all sizes

The pandemic brought about a major shift in the way businesses operate - companies are increasingly distributed, working with overseas vendors and expensing payroll in different currencies as remote work continues to gain traction. In adopting digital-first strategies to boost their growth engines and scale their businesses, SMEs' foreign currency needs have multiplied. And as borders reopened, businesses have accelerated their global expansion plans.

To equip businesses with the necessary tools for internationalisation, YouBiz offers a smart expense management platform that brings together multi-currency accounts, local and international transfers, corporate expense management and credit features in a single hub. SMEs get instant access to accounts and transactions through a comprehensive dashboard, and an entire suite of payment features that allow local companies to be more productive with their business and prudent with spending. They also enjoy unlimited 1% cashback on all card spend with no cap, as well as earn attractive rewards on their corporate expenses.

With YouBiz's best exchange rates and zero foreign currency transaction fees proposition, SMEs can reduce operation costs, manage budgets and accumulate additional funds to power business operations beyond Singapore.

"SMEs have responded positively to our new features and many companies have onboarded YouBiz since our launch in May. Our outreach has strengthened YouBiz's position as a trusted, reliable and effective partner for local companies. We are proud to be one of the fastest growing fintech SMEs in the region and will continue to build better, more affordable and convenient digital financial services for businesses in the years to come," she added.

Registration for a YouBiz account and card is free - no minimum account balance or card fees are required. Businesses can start creating their YouBiz card and account here.

Hashtag: #YouTrip #YouBiz

About YouTrip

YouTrip is a Southeast Asian financial technology company dedicated to creating the next generation of digital financial services for consumers and businesses. In 2018, it launched the region's first and leading multi-currency payment app. With its consumer and corporate products, YouTrip and YouBiz, the company empowers users with the most affordable and convenient financial innovations.

The company is a Major Payment Institution licensed by the Monetary Authority of Singapore (MAS), and owns principal memberships and issuing licences with two of the largest card schemes, MasterCard and Visa. For more information, please visit www.you.co.