Reduce Costs and Streamline Processes with an Advanced Payroll System

- Written by NewsServices.com

Definition of an Advanced Payroll System

An advanced payroll system is a computerized system that automates the process of calculating, tracking, and paying employee salaries. It eliminates manual calculations and provides employers with an efficient way to manage their payrolls.

The primary components of an advanced payroll system include software, hardware, and data storage solutions, as well as rules-based processing systems. The software component includes the core application program that handles wages, taxes, and deductions for all employees. This program also typically includes a graphical user interface (GUI) that allows users to view detailed records of their payments or compile reports on employee hours worked or vacation time taken. If you are looking for professionals that specialize in advanced payroll systems, click the link: https://stratusgroup.com.au/myob-advanced-payroll-systems/.

The hardware component stores data related to wages, taxes, and other deductions for each employee in its memory banks. This information may be stored onsite in a server room or offsite in a cloud-based solution such as Amazon Web Services (AWS). Data storage solutions are important for ensuring compliance with governmental regulations related to employee paychecks and withholding amounts from those paychecks.

Rules-based processing systems are the final component in an advanced payroll system setup. These systems use preprogrammed instructions to move money from employer accounts into employee bank accounts based on predetermined criteria such as salary amounts or hourly rate calculations.

Benefits of an Advanced Payroll System

In today's ever-evolving business landscape, one of the most important elements of success is having a reliable payroll system in place. An advanced payroll system offers numerous benefits to both employers and employees, making it an invaluable tool for any organization.

For employers, an advanced payroll system can provide significant time savings by streamlining the entire payroll process. By automating the process of collecting employee data and calculating taxes and deductions, companies can save time and money on labour costs associated with manual record keeping. Additionally, since all financial information is stored in one secure location, there are fewer chances for errors or discrepancies that could lead to costly mistakes down the line.

For employees, an advanced payroll system provides increased accuracy when it comes to wages and deductions as well as improved access to their financial information. With an automated system in place, paychecks are distributed more quickly than if done manually; this not only ensures employees receive their wages on time but also maintains good morale throughout your organization. Furthermore, employees can easily access their records through a secure online portal which allows them to check their current earnings as well as manage other aspects of their financial lives such as tax returns or retirement planning options.

Features of an Advanced Payroll System

The modern workforce relies heavily on technology to keep the business running smoothly and efficiently. This is especially true when it comes to payroll; an advanced payroll system provides several features that can help streamline the payroll process and make it easier for employers and employees alike.

One of the most important features of an advanced payroll system is its ability to handle multiple currencies. This allows businesses that operate in different countries or regions to pay their employees in their local currency, while still being able to track payments, deductions, and taxes across all locations. Advanced systems also allow employers to customize tax rates on a per-employee basis, which makes sure everyone is paying the right amount no matter where they live.

Another key feature of an advanced payroll system is its ability to integrate with other software programs such as accounting or HR systems. This allows for data sharing between departments so everyone can access up-to-date employee information quickly and easily. It also helps reduce paperwork since all relevant information from different programs can be saved within one centralized database.

Finally, a truly advanced payroll system should provide basic reporting capabilities so employers can view real-time insights into their workforce’s activity levels and performance metrics at any given time.

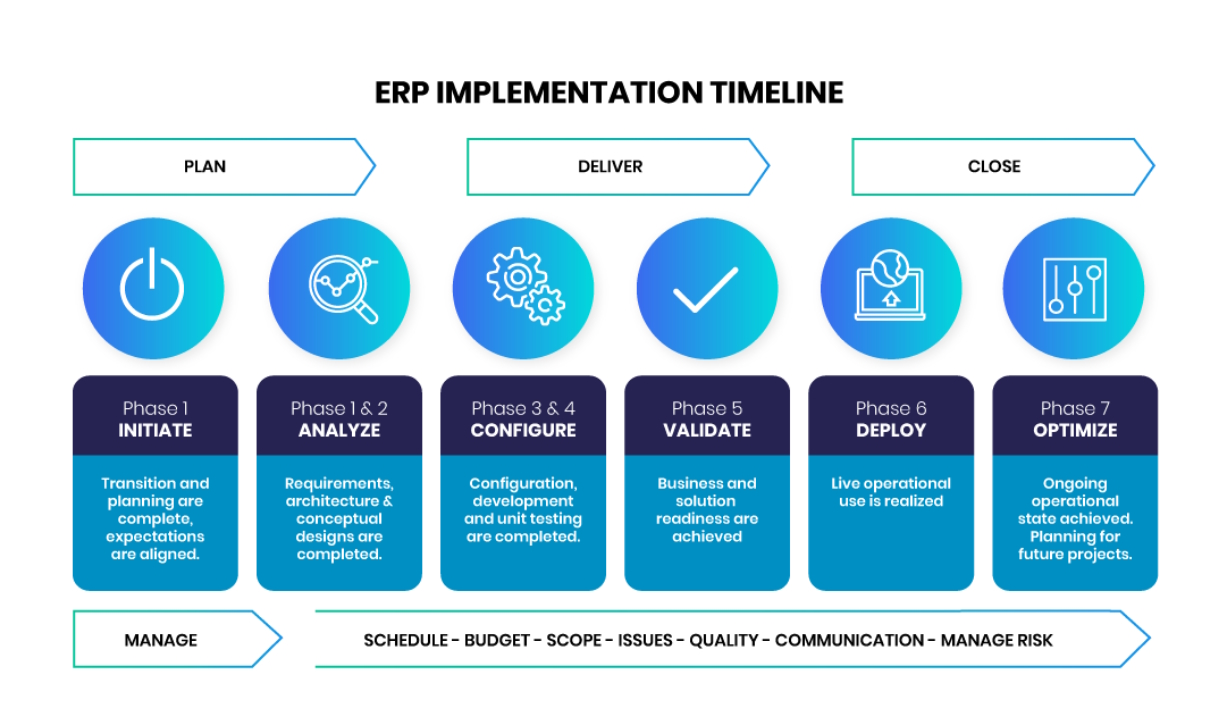

How to Implement an Advanced Payroll System

For many businesses, the payroll system is one of the most important components to ensure that employees are paid correctly and on time. However, with rapidly changing technology, businesses must update their payroll system to remain competitive and efficient. Implementing an advanced payroll system can provide a business with greater accuracy and control over its employee salaries and deductions.

The first step in implementing an advanced payroll system is to select the right software for your company’s needs. Many different types of payroll software are available in the market today, so it’s important to research each one carefully before making a decision. Consider factors such as price range, scalability, features offered by each program, compatibility with other applications (such as accounting programs), customer support options available, and any additional services or updates offered by the vendor.

Once you have selected your preferred software package, it’s time to begin setting up your new system within your organization. This includes designing data entry screens for entering employee information; ensuring that all necessary records such as taxes are accurately calculated; setting up security protocols for accessing sensitive information; creating reports for tracking pay periods; integrating other applications (such as human resources) into the new system; and testing out all features before launching it live.

Challenges Associated with an Advanced Payroll System

The growing complexity of payroll systems can present a challenge for businesses. An advanced payroll system offers several benefits, such as streamlining processes and providing greater accuracy, but it also requires significant investment and resources to implement and maintain. This article will explore the challenges associated with implementing an advanced payroll system.

One of the biggest challenges when implementing an advanced payroll system is ensuring compliance with applicable laws and regulations. The federal government, as well as individual states, have specific laws that must be followed when calculating paychecks; failure to comply can lead to hefty fines or other penalties. Additionally, businesses may need to navigate through different tax rules depending on their location or the type of organization they are operating. Businesses must understand these rules before making changes to their payroll system so they don’t inadvertently violate them.

Another common challenge is finding the right software for your business needs. There are a variety of different programs available ranging from basic solutions to more complex enterprise-level systems; it’s important to find one that fits your company size, budget, and specific requirements for accuracy and reporting capabilities. Businesses should also consider the cost of training employees on how to use the new software; this could be a major expense if multiple users need instruction.

Conclusion

The implementation of an advanced payroll system has the potential to revolutionize a business's ability to accurately and efficiently manage payroll. It can provide employers with improved accuracy, increased visibility, better security, and a more efficient overall process. All of these benefits can lead to higher employee satisfaction rates and greater cost savings for businesses. In short, the advantages of an advanced payroll system make it an invaluable tool for any business looking to improve its efficiency and maximize its profits.