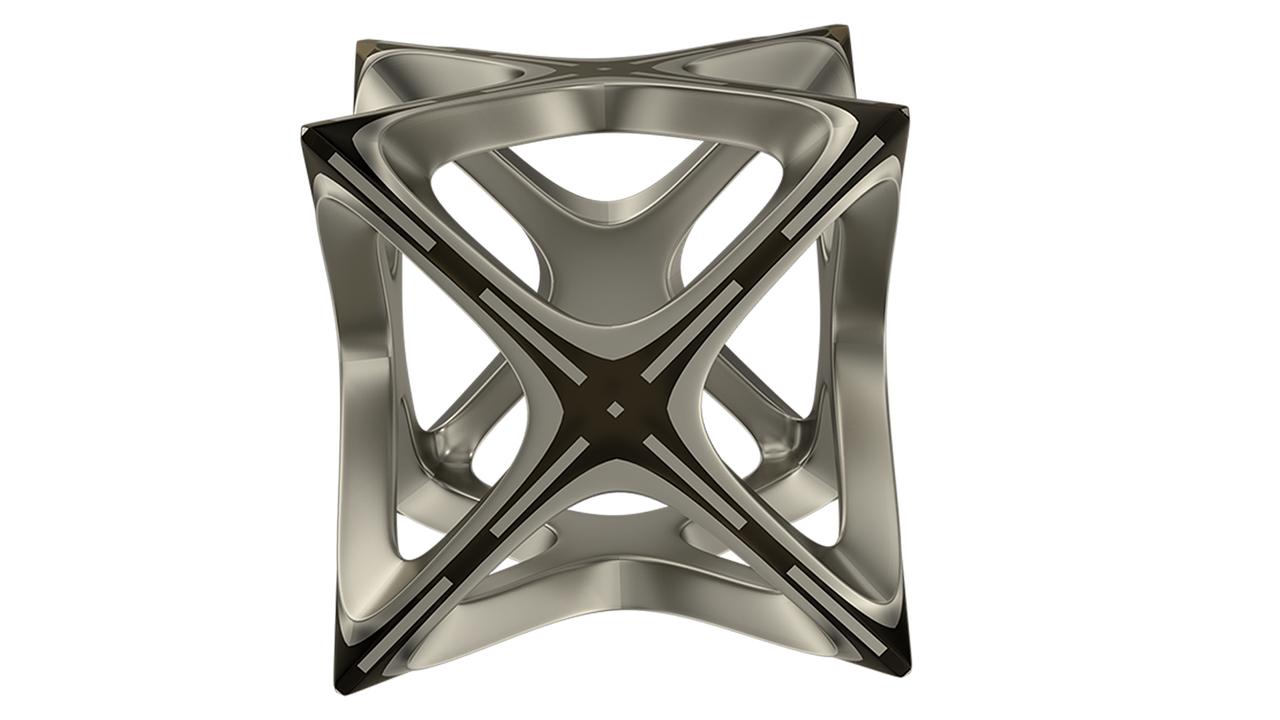

7 advantages of investing in a platinum bar

- Written by News Company

Investing in the platinum bar or palladium is a novel phenomenon, and most people do not know much about it.

Platinum is a word that most of us would have heard: platinum account, platinum card, and a platinum membership.

What we may not have perceived is that the word platinum is always associated with a thing of high value.

The highest value membership card is known as the platinum card. If you have a platinum card, you will be getting the best treatment offered. You will also get the finest chairs in a restaurant, and have the best seats within the cinema.

It means that anything that has platinum associated with it is high in value. Why should this not apply to investments?

While making an investment decision, the biggest concern of the investor is the risk associated with the commodity or the instrument in question. If the risk is high, the investor will seek maximum gain. However, most investors are seeking an investment avenue that provides them reasonable returns with the minimum risk associated. Sometimes new investors may look to use the services of a professional broker to ensure that their investments are somewhat secure and low-risk. If this is something that you might be interested in when starting out with your first investments, then it might be worthwhile checking out the likes of Banx im Test to see how such a broker operates and how trustworthy they could be with your investments.

It means that a stable investing option is always on the cards which offer the investor with solid positions both in the short term and the long run.

In the article below, we will be discussing a few advantages of investing in the platinum bar for the benefit of the reader.

1. Solid Historical Background

Platinum offers are solid historical background. Spinach explorers first discovered it in Columbia in the sixteenth century. They called it platinum and didn’t give it much importance at that time.

During the nineteenth century, a method was discovered for the production of malleable platinum. Scientists also found that the metal could also be used as a catalyst. With the help of platinum electrodes, a cell was made in mid-1800. It was also used for increasing the efficiency of gasoline.

The metal became popular as jewelry in the 60s. Its demand rose in the US, Asia and Europe. It is being used as a catalyst for converting harmful cases into safe ones in vehicles. It is also very useful in the plastic industry. These days platinum is being used in several modern industries around the globe.

2. Historical Pricing

Platinum is an investment metal that has been showing a rather remarkable shift in pricing. Seasoned investors are using this metal to diversify their investment portfolio and spread their risk across several precious products.

Platinum showed its lowest price in 1974 and had been increasing it ever since. Since 1965, the metal has constantly been showing a bullish after the 2008 financial crisis. It favored by most investors.

3. Current Pricing Shifts

During the past few years, the volatility shown by this metal has been rather remarkable. However, investors are seeing the long term value to be gained from investing in platinum right now.

Platinum has shown some short crests and troughs, but the trend is generally a little downward owing to the prevalent trend in the commodities market.

It means that the platinum proportionally reacts to the market, allowing investors to take positions when the market is slow, and sell when it goes up.

During these short term crests and troughs, there is a chance of making money by investing in platinum. Short-term price movements replicating the overall market allow the investor to make considerable gains in the short term without having to take more risks.

It does not mean that platinum is good for short-term investment purpose only. The metal is also good for long-term investment if the investor can manage the portfolio with other short term gains.

4. Rising Demand for industrial usage

Platinum possesses some properties that are unique to this metal, and cannot be found in anything else. Due to these novel properties, the usage of platinum in high-tech industries has soared manifold. Consequently, the demand for this metal has also risen proportionately.

Platinum can’t be easily corroded. It has a very high melting pint as compared to other metals. It is a good conductor, and also a very good catalyst.

All these qualities render platinum as an essential element in wide-ranging industrial applications. It is a main component of gasoline, special drugs, LCD TVs, fertilizers, fiber optic cables and other very important products.

The metal is also used in modern fuel cells.

5. Price comparison advantage

Several other metals are also used for investment purpose. Among all those investment metals, platinum offers the most interesting price trends.

When we compare its price with another precious metal, palladium, we will see that before the crisis of ’08, the gap in costs between these metals was constantly widening; however, the difference became minimal after the crisis.

It means that the demand for platinum, about palladium – is increasing every day hence the narrowing cost gap. If we follow the current trend, it would mean that platinum will continue to increase in the coming days. Taking platinum positions at this moment will become beneficial in the coming days for all investors who are looking for long term positions.

6. Platinum and Gold comparison

The price of both these metals is not directly related because their fundamental is different. Platinum is an industrial metal whereas gold is purely an investment metal.

It is evident in the market that the price correlation between investment metals and industrial metals is inversely proportional. It is because the factors that affect the price of gold also affect the price of platinum but in an inverse manner.

It is very beneficial for seasoned investors who want to build their portfolio in a diverse manner containing all kinds of investments that perform even during adverse times.

7. Ease of Investing

It is very easy to invest in platinum because the investor has the choice of either investing in Platinum bars or coins.

If you want to take lighter positions in the metal, you can buy coins. On the other hand, a heavy investment may require you to make your investments in Platinum bars.

For retail customers, physical platinum coins maybe a little cheaper than bars.

Conclusion

Global investors use the white metals of Palladium, silver and platinum for hedging against inflation when the market is tough.

Even if there is uncertainty in the demand of platinum will remain constant owing to its widespread industrial usage.

If you want to be part of the global industrial growth phenomenon, you can buy Platinum coins. It can not only provide you with gains when the market is bullish but also absorb your losses to an extent when the market is going down.