BNM’s Policy Rate Call Looms: Octa Broker Highlights Inflation, Exchange Rate and Trade Challenges

- Written by Telegraph Magazine

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 6 May 2025 - This Thursday, Bank Negara Malaysia (BNM) will announce its policy rate decision. While most analysts expect no change, Octa Broker suggests that a rate cut is on the table and is highly likely to take place later this year due to subdued inflation, stronger ringgit, and a higher likelihood for Fed rate cuts.

On Thursday, 8 May, Bank Negara Malaysia (BNM), the nation's central bank, will reveal its policy rate decision. Like most other central banks around the world, BNM strives to maintain a balance between low inflation and sustainable economic growth. Its key monetary policy instrument is the Overnight Policy Rate (OPR). By adjusting the OPR, BNM influences interest rates throughout the Malaysian economy, impacting borrowing costs for businesses and consumers and ultimately influencing economic activity and inflation.

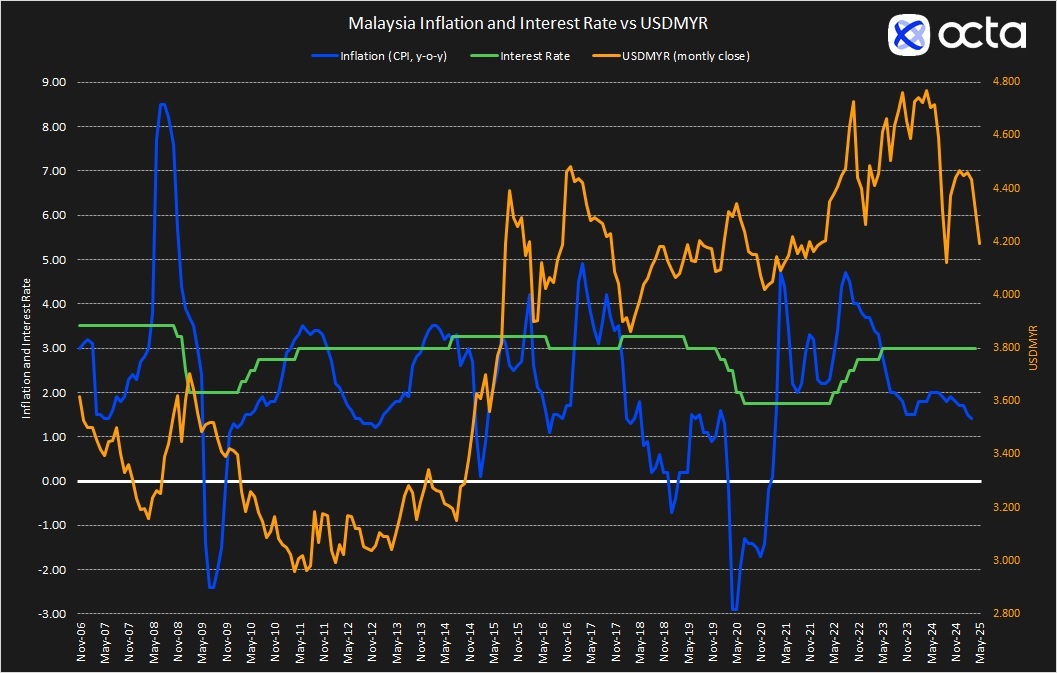

BNM has kept its OPR stable since May 2023, when it surprisingly raised it to 3.00% in response to persistently high inflation amid solid household spending and tight labour market conditions. Since then, the economy has not really slowed much, so BNM has kept its base rate unchanged for almost two years now. This stance distinguishes it from its regional counterparts – Bank Indonesia, the Bank of Thailand, the Philippine central bank, and the Bank of Korea – all of which have lowered interest rates to stimulate economic growth.

In fact, the latest official figures showed that Malaysia's economy showed surprising strength in Q4 2024. Gross domestic product (GDP) outperformed both official estimates and market expectations, growing by 5% year-on-year in Q4 2024. According to BNM, the GDP growth was driven by robust domestic demand, strong investment, and recovering exports. Meanwhile, national inflation has continued to decelerate, with Consumer Price Index (CPI) hitting a three-year low of just 1.4% in March 2025. Indeed, even with reduced government subsidies for diesel, electricity, and chicken, overall inflation has been successfully managed, potentially allowing the BNM to cut its base rate later this year. However, an overwhelming majority of economists polled by Reuters see no policy change this year, suggesting the central bank will wait and see how external and domestic factors unfold.

“The Malaysian economy is doing rather well, but major risks lie ahead, particularly stemming from its high degree of openness. With global trade tensions rising, Malaysia interconnectedness and integration into the global supply chain could exert a negative impact on GDP", says Kar Yong Ang, a financial market analyst at Octa Broker. Indeed, according to the latest report from the Ministry of Investment, Trade and Industry (MITI), Malaysia recorded a trade surplus of 24.72 billion ringgit in March, well above the poll forecast of a 13.8 billion ringgit surplus. Most importantly, Malaysia's exports to the United States rose to a record high of 22.66 billion ringgit ($5.14 billion) in March, a 50.8% increase from a year earlier, buoyed by strong demand for electrical and electronics products. However, with the United States introducing import duties on Malaysia as well as on Malaysia’s key trading partners – particularly, China – the strong pace of exports may not last. BNM has recognized this risk in its latest statement: “The growth outlook is subject to downside risks from an economic slowdown in major trading partners amid heightened risk of trade and investment restrictions, and lower-than-expected commodity production”.

Although the market largely expects the BNM to keep its base rate unchanged for the 11th consecutive time on Thursday, Octa Broker analysts argue that the chances of a rate cut have increased particularly because the U.S. Federal Reserve (Fed) may also be willing to cut the rates soon. “With inflation subdued, USDMYR trading at a seven-month low, and rising expectations for a dovish Fed, I think BNM is seriously thinking about when it may need to cut the rates”, says Kar Yong Ang. Indeed, after last week's U.S. GDP data came below expectation, the risk of recession in the U.S. has increased and the market is now pricing in a 47% of 50 basis points (bps) worth of rate cuts by the Fed by the end of Q3 2025. The dovish Fed may put an additional bearish pressure on USDMYR, highly improving the probability of an eventual BNM rate cut.

___

Disclaimer: This content is for general informational purposes only and does not constitute investment advice, a recommendation, or an offer to engage in any investment activity. It does not take into account your investment objectives, financial situation, or individual needs. Any action you take based on this content is at your sole discretion and risk. Octa and its affiliates accept no liability for any losses or consequences resulting from reliance on this material.

Trading involves risks and may not be suitable for all investors. Use your expertise wisely and evaluate all associated risks before making an investment decision. Past performance is not a reliable indicator of future results.

Availability of products and services may varyby jurisdiction. Please ensure compliance with your local laws before accessing them.

Hashtag: #Octa

The issuer is solely responsible for the content of this announcement.

Octa

Octa is an international CFD broker that has been providing online trading services worldwide since 2011. It offers commission-free access to financial markets and various services used by clients from 180 countries who have opened more than 52 million trading accounts. To help its clients reach their investment goals, Octa offers free educational webinars, articles, and analytical tools.

The company is involved in a comprehensive network of charitable and humanitarian initiatives, including the improvement of educational infrastructure and short-notice relief projects supporting local communities.

In Southeast Asia, Octa received the 'Best Trading Platform Malaysia 2024' and the 'Most Reliable Broker Asia 2023' awards from Brands and Business Magazine and International Global Forex Awards, respectively.